This holiday season, consider giving yourself a gift that keeps on giving—solar energy. Not only does it bring long-term savings, but investing in solar now could also yield immediate financial benefits with tax credits and rebates available through the end of the year.

Year-End Tax Credits and Incentives

One of the best reasons to go solar now is to take advantage of the Federal Solar Investment Tax Credit (ITC), which allows you to deduct 30% of your solar installation cost from your federal taxes. Many state programs offer additional incentives, so check if you’re eligible for any local rebates to maximize your savings.

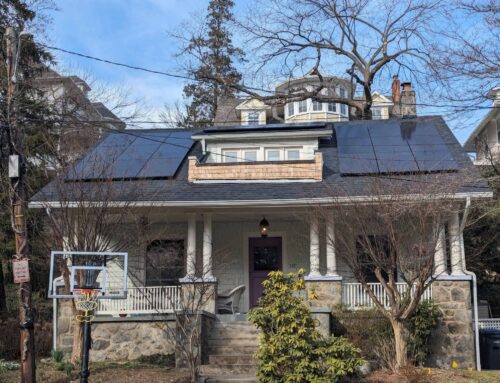

A Gift for Your Wallet and the Planet

Solar energy reduces electricity costs by generating power directly from the sun. This means you can avoid seasonal rate increases from your utility provider. Plus, a typical 6 kW solar panel system can save a household about $600 to $1,000 per year in energy costs.

Embrace the Season of Savings with Solar

With the combination of tax credits, energy savings, and environmental benefits, going solar is a meaningful gift to yourself and the planet. Plus, once installed, solar panels typically last 25–30 years, giving you decades of benefits.

Give yourself the gift of savings this holiday season. Reach out to District Energy LLC today to learn about end-of-year solar incentives and get started on your journey to clean energy.