Utility and Tax Incentives

Federal, state, and local governments understand the importance of sustainable energy and the high costs associated with traditional power sources. Utility companies can’t afford to maintain their infrastructure costs as homes use more and more power. That’s why, in most cases, utility and tax incentives can save customers well over 50% on the cost of energy.*

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.

Washington DC Solar Incentives

When you install a solar system in DC, the most important solar incentives to be aware of are solar renewable energy certificates (SRECs). The District is one of the places that offer this performance-based incentive to people generating solar electricity. Even better, its program is the most lucrative one in the country: when you buy and install a solar panel system in DC, you can earn thousands of dollars each year just from selling the certificates your system generates.

The amount you can earn in SRECs depends on supply and demand as well as how much electricity your system generates. You generate one SREC for every megawatt-hour (MWh) of electricity produced. So, an average eight-kilowatt system generates about 10 MWh per year. The current cost of an SREC is between $380-$435. That means the average solar household could earn over $3,800 per year.

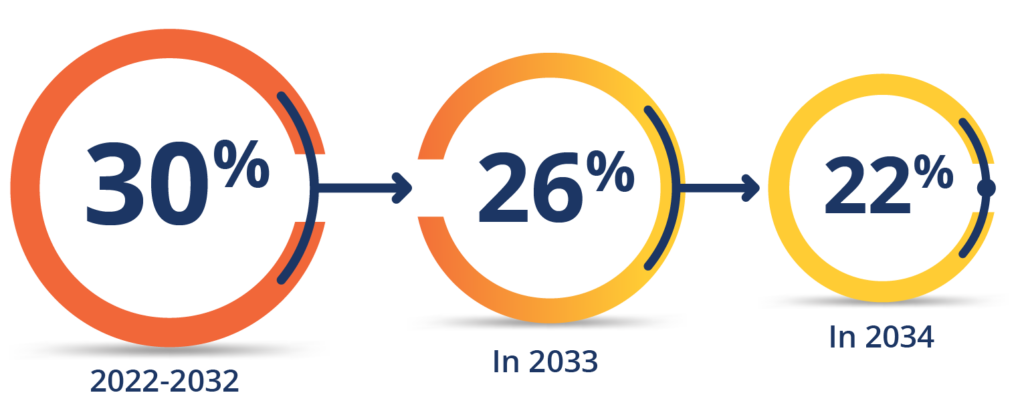

Federal Investment Tax Credit – 30%

The solar investment tax credit (ITC) is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The federal ITC is based on 30% of the homeowner’s cost to install solar from 2022-2032. Don’t wait; prices for solar equipment are on the rise!

Property Tax Exemption – 100% through 2024

Installing solar panels on your home increases its value by up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision, and many state legislators agree! Until the end of 2024, new solar installations will be subject to no additional property taxes based on their assessed value.

Increase Home Value

Having a residential solar energy system on your property is known as a capital improvement which adds to your property’s value. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax basis investment can be deducted from the sale’s price, reducing the amount of the price that is counted as profit. This reduces the taxes taken from the sale and may be able to help you avoid capital gains taxes on the appreciation.